News

STPG SCOUTING TRA PARTNERS GROUP BECOMES SCOUTING CAPITAL & FAMILY ADVISORS

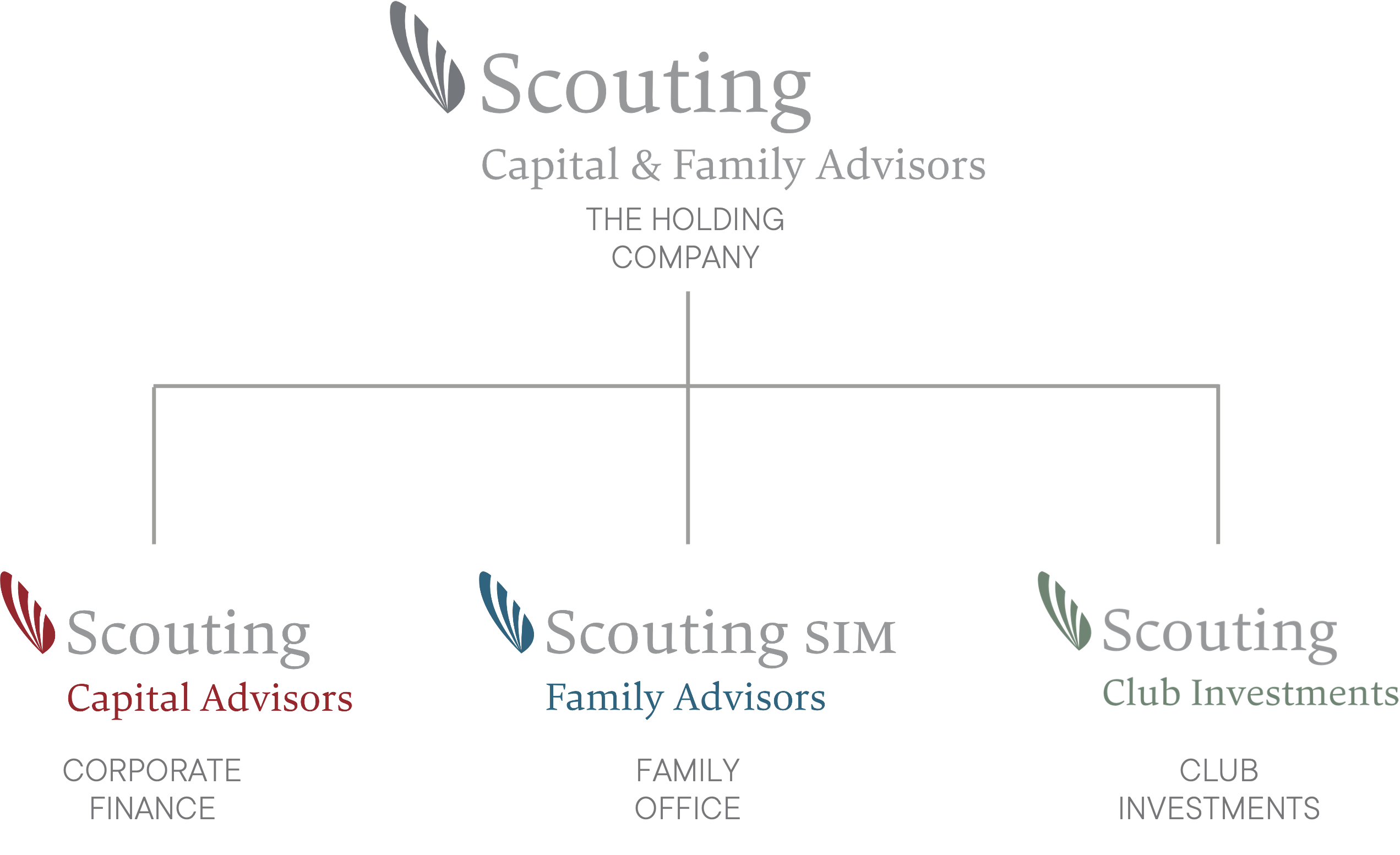

- Milan, 5 June 2024 – STPG Scouting Tra Partners Group, an independent and supervised entity registered with CONSOB that operates on the market as an international Financial Advisor active in the Corporate Finance and Family Office sectors, announces important changes in the group’s structure starting with the strategic rebranding in light of the group’s evolution and growth over the last 20 years. As of today, the financial reality becomes Scouting Capital & Family Advisors, a choice dictated by the desire to make the holding company and its business units immediately recognisable on the markets, streamlining the nomenclature but maintaining the now iconic “wing” that has distinguished the company over the years.

- After having recently launched the Capital Markets business unit, with which it consolidated its activity in the area of transactions on the listed markets of Borsa Italiana, the company announces that it has become a ‘Group of SIMs‘, in accordance with regulatory provisions. This choice is dictated by the desire to offer its clients further transparency, thanks to its registration in the register kept by the Bank of Italy and its supervision on a consolidated basis by Consob.

- Scouting Capital & Family Advisors is also ready to launch Scouting Club Investments, a new supervised equity investment platform operating in the Club Deals sphere, thanks to the entry of Managing Director Chiara Venezia. The tool will allow the families that gravitate around the Scouting world and the main institutional operators to invest in Private Equity through regulated vehicles under Italian or Luxembourg law, set up specifically to hold a stake in the target company.

- “Following the constant growth and evolution of the group, we felt the need to identify ourselves more directly with our interlocutors in order to communicate in an immediate way who we are, what we do and how we operate in the market,” says Rinaldo Sassi, Founder and CEO of Scouting Capital & Family Advisors. “This moment represents a new starting point and allows us to present ourselves to the market more united, transparent and supervised, strengthened by the experience we have gained in over 20 years of activity. Moreover, having become a ‘Group of SIMs’, maintaining a direct and highly personalised relationship with our clientele made up of large Italian entrepreneurial families, makes us a unique reality on the financial scene“. Concludes Sassi: “With the launch of Scouting Club Investments and a ‘from family to family’ vision, we will offer clients a proactive and well-rounded approach to investing, considering not only the expected return, but also the impacts on economies, society and the environment.”

- The holding company, established in 2001, now has 6 partners (Rinaldo Sassi, Filippo Bratta, Davide Milano, Ilaria Mori, Marco Musiani and Giuseppe Mario Sartorio) and over 50 professionals from renowned national and international investment banks. It has offices in Italy (Milan, Parma, Bologna and Turin) and operates in Europe and major non-European markets through a network with over ten years’ experience .

- The group, through its companies, is active in the fields:

- Corporate Finance: through Scouting Capital Advisors, a company with a prevailing focus on cross-border M&A transactions and a significant track record of deals completed in the interest of some of Italy’s most important family-owned companies, completed in North and South America, Asia, Japan and Europe. The company also offers comprehensive advisory services to listed and IPO companies through its Capital Markets Business Unit, a division that allows the group to operate on the markets of Borsa Italiana, offering support to issuers, banks and shareholders in major IPOs and public M&A transactions.

- Family Office: through Scouting SIM Family Advisors (formerly Tra Partners Scouting SIM), a company supervised and registered with CONSOB, the Group proposes an innovative approach to the care, custody, preservation and protection of large private assets in Italy, inspired by the typical philosophy of American foundations. The commitment to renewing the investment sector is also manifested through the decision to become a stakeholder of a relevant and innovative international provider of cutting-edge aggregation and analysis services. This partnership not only enriches the offering with state-of-the-art technology solutions, but also facilitates participation in a global Family Office community, providing high quality, customised services suitable for both individual and multi Family Offices. This approach makes it possible to offer advanced tools to aggregate and consolidate assets, centralise wealth information, simplify decision-making processes and optimise investment strategy, ensuring greater efficiency and transparency according to the highest industry standards.

- Club Deals: through Scouting Club Investments, organises syndicated investments in the capital of unlisted companies in Italy and abroad. Using an equity investment platform supervised by the relevant regulatory authorities, exclusive Club Deals are structured, making available to large entrepreneurial families individual alternative investment funds dedicated to distinct business targets.